I have been associated with Softax since 1997 and we have been implementing banking projects since the mid-1990s. It was a time of transition to new systems, migration time and building appropriate solutions related to them.

I remember the times of cooperation with the American company Digital Equipment, which entered Poland in 1991, mainly with the offer of computer equipment and ready-made software running on it.

In addition, the company offered the DECbank FBS banking system, which served more as a branch support platform capable of interfacing with the central banking system. DECbank broke the idea of working on one mainframe system.

Digital was acquired by COMPAQ and then in 2002 by Hewlett Packard (HP).

We were strongly associated with them at the beginning of the company's operations as subcontractors of banking IT projects. Initially, our knowledge and competences in the field of banking systems grew on this cooperation.

In addition, we have rubbed against companies such as: Sanchez, Temenos, FIS-FNS, Accenture, and more specifically Alnova Technologies. Companies with hundreds of implementations of their banking systems. So we are talking about world giants in this area, and we had contact with their banking systems.

We learned about the strengths and weaknesses of these systems, and such a small company as ours was effective in providing solutions just covering their shortcomings and weaknesses. This is also how our competences were built. Projects that we implemented close to core banking systems were the value.

The knowledge gained in dozens of projects implemented over 25 years in the largest Polish banks, always taking into account the specificity and functionality of core systems, reflected on the architecture of the solutions we designed.

Why so many core systems projects?

This is due to the specific situation in Polish banking. The last 25 years have been a period of dynamic changes in banks' IT infrastructure. The change of architecture is primarily a transition to a service model based on an ESB bus, multi ESB, with a server part containing core banking systems and a channel part providing dedicated interfaces for customers through channels such as: WWW, WAP, IVR, Call Center available by phone, SMS then a new mobile channel. All as an alternative to branches (and these also received new interfaces). Replacing old systems with more modern ones that provide appropriate APIs resulted in migration and integration projects.

Banking

BankingAt the beginning, we implemented projects for BRE Bank operating with the Globus system by Temenos. Another was the electronic banking project for Handlobank (operating on the Profile system and then migrated to CitiBank systems), then we implemented the project of launching one of the first (next to mBank) Inteligo virtual bank (also with the Profile system).

In 2004, we participated in the project of creating electronic banking for Lukas Bank (now Credit Agricole). There, the Polish product def2000 was working on the core system side.

After the takeover of Inteligo in 2002 by PKO BP, we started cooperation with the largest Polish bank. We have implemented electronic banking projects: iPKO, iPKO Biznes (project for business clients), iPKO Junior (project for children up to 13 years of age) with the integration of processes with core systems.

In the meantime, we were connected with the project of migrating Inteligo customers from Profile to Alnova.

And then from the CESAR2 departmental system to Alnova. In this venture, both systems were running simultaneously for some time and the customers were migrated successively. Our middleware knew which system to work with at the moment.

At Bank BGŻ (now BNP Paribas), we have implemented an integration bus, which required integration not only with the core system, but also with all bank systems.

During the cooperation with Pekao SA, we gained experience in integration with the Rocket (Systematics) system.

In the project with Alior Bank, we returned to cooperation with the Profile system.

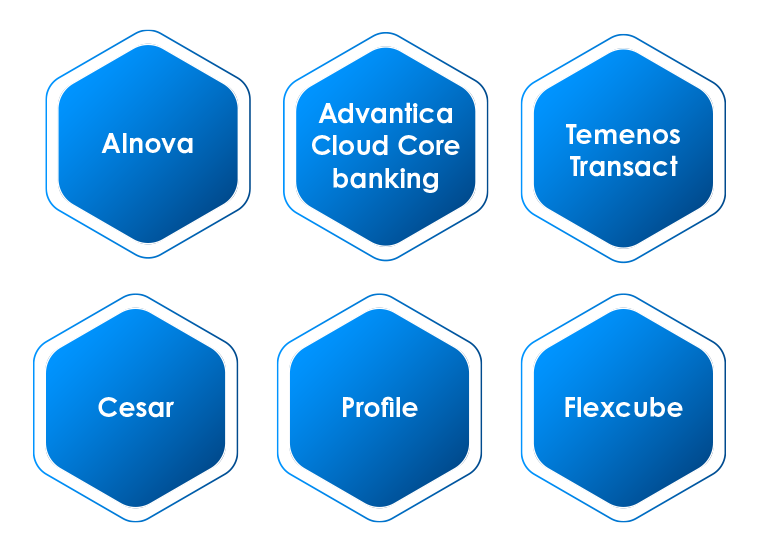

All these projects were related to cooperation (and gaining knowledge and experience) in the field of core systems such as Fidelity Profile (Sanchez company until 2004), Temenos Globus (which was called T24, TCB, and now Temenos Transact), Alnova Financial Solutions (Accenture), Cesar, Flexcube, Systematics and the Polish core system defBank (defBank 2000 and later defBank 3000) by Asseco.

Bank consolidations, and thus data migrations between systems in PKO BP, Pekao SA, Lukas Bank (Credit Agricole), BGŻ (BNP Paribas), BRE Bank (now mBank) also influenced the competences we acquired, which translated into for our solutions. Everyone who has participated in migration or integration projects knows what details related to the specificity or limitations of core systems need to be entered and how to use or circumvent them to bring the expected functional value in the organization.

The expectations of high availability of channels, and thus of banking services, meant that we had to create solutions maintaining the availability of these services in the event of problems with large core systems. These were the beginnings of our proprietary Advantica system. It was not a planned project. The system grew out of the fact that it covered the functionality of core systems when:

- they were overloaded,

- supported EOD (End Of Day)

- there was a failure,

- it was simply cheaper to order from us to circumvent functional limitations than to order them and implement them in such a core system.

We duplicated the maintenance and service of bank accounts, settlements, and billing functionalities, often in order to relieve the main systems, but thanks to this, we also gained very valuable and hardly available knowledge.

Birth of the Advantica Cloud Core Banking

IT companies followed different paths - some specialized in large foreign solutions (mentioned above), others created their own solutions resulting from the market needs, and we simply implemented projects based on them, creating specific, modular products made of many elements.

And this is how Advantica was founded in Softax. A system consisting of many modules that allow for adjusting the functionality to the real needs of banks, fintechs or other financial institutions, providing a comprehensive version with the full functionality of the banking system, or, if necessary, simply supporting core systems operating in the organization.

Advantica's main modules provide key solutions for:

- analytical and general ledger,

- customer files,

- handling deposit and credit accounts of individuals and companies,

- domestic, foreign and currency settlements (Elixir, Express Elixir, Sorbnet, Sepa, Swift, Euro Elixir, Target),

- customer creditworthiness assessment,

- servicing credit products as well as broadly understood issuing and servicing of payment cards (multi-currency, debit, credit, charge and pre-paid).

Therefore, today our Advantica Core Banking can easily compete with systems such as: Profile system by Fidelity National Information Services Inc., Alnova Financial Solutions by Accenture, or Temenos Transact, and on our home garden the defBank system by Assecco.

Core banking systems

Core banking systemsThe advantage of our solution is that Advantica was built modularly from the beginning, which significantly improves the implementation of changes and ensures shortening the TTM (Time To Market) period.

In addition, we have recently successfully carried out an internal project of launching Advantica in the cloud on Kubernetes (K8s), which further increases the efficiency of the system and enables the transfer of management and administration to the cloud provider.

Times change.

PSD2 opens the world of financial services to startups, and startups need proven, safe and, above all, implemented solutions. We know this, which is why we decided to create an ecosystem in which users can test an environment not dedicated to a specific bank, but general to the handling of financial services.

Advantica Cloud Core Banking will soon be made available to a wide group of users. You will be able to set up a test account, make transfers, manage financial products, set up a virtual card, all on the cloud version of the system.

Stay tuned.